Plan B talks get louder

The Biden campaign’s attempts to soothe panicked Democrats and donors after the president’s calamitous debate appear to have cratered.

One Democratic lawmaker has openly called on President Biden to withdraw from the race, while others are sharply criticizing his campaign’s response. Polls show his approval ratings are falling. And many party backers remain as nervous about sticking with him as they were last week — but also worry about the alternatives.

The latest: Representative Lloyd Doggett of Texas became the first sitting Democrat to demand that Biden step aside. And some Biden allies qualified their post-debate defenses: Representative Jim Clyburn of South Carolina told The Hill on NewsNation, “I think that the American people want an explanation.”

Barack Obama has said privately that Biden’s already tough fight has gotten harder, according to The Washington Post. Democrats and foreign allies worry that Biden has increasingly seemed confused or listless, The Times reports.

And 75 percent of respondents in a new CNN poll said they would prefer someone else atop the Democratic ticket.

Team Biden was continuing to try to tamp down concerns, with the president scheduled for an interview with ABC News’s George Stephanopoulos. The White House was also weighing Biden visiting Wisconsin and Pennsylvania in the coming days. More crucially, it was also planning a meeting on Wednesday with Democratic governors, after they expressed frustration about the Biden camp’s debate response.

Biden told donors at a fund-raiser on Tuesday that a recent grueling travel itinerary contributed to him falling “asleep on stage,” adding that was not “an excuse, but an explanation.”

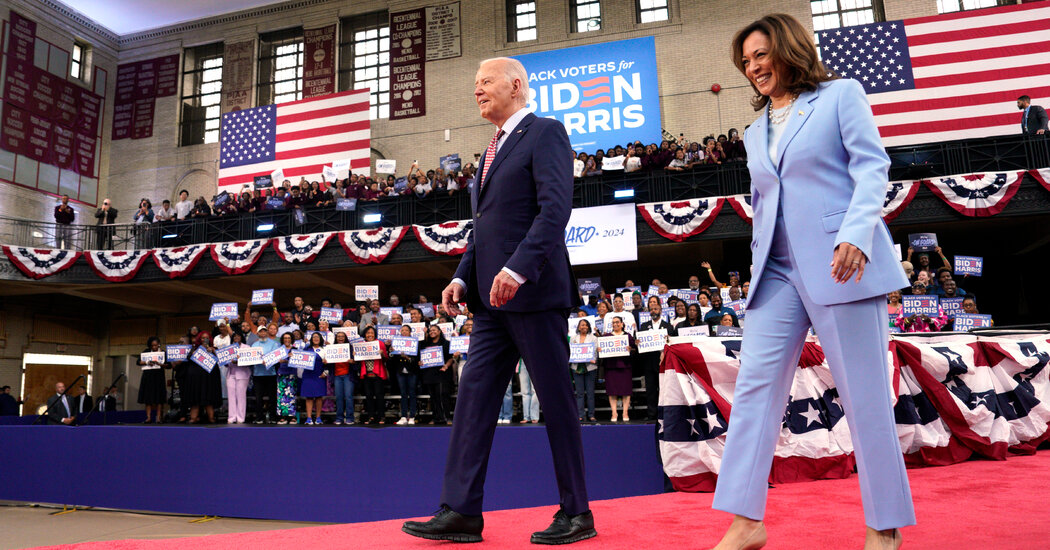

Talk about Vice President Kamala Harris as the most viable Plan B is growing, even if forcing Biden to step aside remains exceedingly difficult. Other potential candidates have been mentioned, including Gov. Gavin Newsom of California and Gov. Gretchen Whitmer of Michigan. (Like Harris, all have publicly backed Biden.)

But Harris is the leading alternative. One reason is money: She is the only potential candidate who could directly assume the Biden campaign’s $240 million in funds, since she’s his running mate. Anyone else would face significant challenges in taking over that money, with only months to go before the election.

Moreover, the CNN poll showed Harris performing better against Trump than her boss. Key Democratic officials, including Clyburn, said they would back her if she became the nominee. And Harris has a coterie of well-heeled supporters, including Brad Karp, the chair of the Wall Street law firm Paul Weiss; Jon Henes, the C.E.O. of C Street Advisory Group; and Donna Langley, the chair of NBCUniversal.

Yet some in the donor class have doubts about Harris. The tech mogul Reid Hoffman was among her biggest donors in the last election cycle. But Semafor reports that his top political adviser, Dmitri Mehlhorn, told backers of the super PAC American Bridge that switching to the vice president would drive away crucial undecided voters. “Kamala Harris is more threatening to those swing voters than a dead Joe Biden or a comatose Joe Biden,” Mehlhorn said.

And the lawyer John Morgan told The Times that a scramble for a Plan B “could cause more infighting and do more harm than good.”

HERE’S WHAT’S HAPPENING

Tesla shares rally on better-than-expected vehicle delivery numbers. The electric carmaker’s stock was up in premarket trading on Wednesday and jumped 10 percent on Tuesday, after it reported vehicle shipments that exceeded analysts’ forecasts. But a questionnaire by The Times suggests that Elon Musk’s divisive political views may be weighing on Tesla sales.

Sentencing in Donald Trump’s Manhattan hush-money case is delayed. The presiding judge in the case agreed to postpone the matter to Sept. 18, from July 11, to consider how a recent Supreme Court ruling on presidential immunity affects the conviction. Separately, Rudy Giuliani, the former New York City mayor and Trump confidant, was disbarred in New York over his role in trying to overturn the 2020 presidential election.

Apple will reportedly get an observer role on OpenAI’s board. Phil Schiller, the head of the tech giant’s App Store, will get a nonvoting position as part of the deal to bring ChatGPT to iPhones, iPads and Macs, according to Bloomberg. Microsoft, an investor in OpenAI and a sometime Apple rival, already holds a similar seat, posing potential complications.

The F.D.A. approves Eli Lilly’s new Alzheimer’s drug. The pharmaceutical company’s donanemab, one of a new class of treatments for the disease, was shown to moderately slow the rate of cognitive decline in patients; its list price is $32,000 for a year’s course. But shares in Lilly fell after President Biden and Senator Bernie Sanders, independent of Vermont, called out the company over the high cost of its weight-loss treatment, Mounjaro.

Paramount and Skydance: the final chapter?

The summer’s biggest Hollywood blockbuster may finally be nearing its conclusion. Shari Redstone has reached a preliminary deal to sell her controlling stake in Paramount to David Ellison’s Skydance, weeks after talks broke down at the last minute, DealBook’s Lauren Hirsch and The Times’s Ben Mullin report.

The big question now: Will the new deal stick?

A recap of the most tortuous media deal in recent history: After months of discussions, Paramount and Skydance, the film studio behind “Top Gun: Maverick,” closed in on a deal last month. Skydance would buy National Amusements, the holding company through which Redstone controls Paramount, and then merge with Paramount.

But just as a special committee of Paramount directors was set to vote on the deal, lawyers for National Amusements emailed them to say it was ending the talks.

Paramount was preparing to go it alone. The company outlined what that might look like after the Skydance deal fell apart. But investors were unconvinced: Paramount’s shares have fallen more than 16 percent over the past month.

Media watchers criticize Paramount, which owns CBS, MTV and Nickelodeon, for its relatively late start on streaming and missed opportunities, including selling trophy assets like Showtime and BET. It’s also saddled with about $14 billion in debt.

The Skydance-Paramount talks picked back up soon after the original deal fell apart. Here’s what’s under discussion this time:

-

Skydance has agreed to pay slightly more for National Amusements: $1.75 billion, rather than $1.7 billion.

-

The new deal will give National Amusements more protection against potential shareholder lawsuits. That was a key sticking point in the earlier negotiations; non-Redstone shareholders worried that their stakes could be diluted.

-

Paramount is expected to secure a 45-day “go shop” period, during which it can talk to other suitors. (Those interested in buying National Amusements include Barry Diller’s IAC, Edgar Bronfman Jr. and Bain Capital, and Steve Paul, the Hollywood executive behind “Baby Geniuses.”)

It’s now up to Paramount’s special committee. Last time, Redstone killed the deal before it got to a vote. This time, she’s sending the directors a deal she’s already blessed.

A look ahead to Friday’s jobs report

The S&P 500 notched its 32nd record of the year on Tuesday. But the rally wasn’t fueled by the euphoria about artificial intelligence that has sent markets soaring in recent months. Instead, it was down to Jay Powell.

At the European Central Bank’s annual summit in Sintra, Portugal, the Fed chair said that inflation appears to be in retreat. But, he added “what we’d like to see is more data” to reinforce that view before making a call on when to start cutting interest rates.

The next big piece of data comes on Friday. The June jobs report is expected to show a significant tail-off in hiring. Will that be enough evidence for the central bank to lower borrowing costs before Election Day?

The markets seem to think so. Futures traders on Wednesday were pricing in a 75 percent chance of a rate cut at the September meeting. That’s even as Powell himself cautioned Tuesday that he wasn’t going to be “landing on any specific date.”

Here’s what economists expect to see in the jobs report:

-

They think employers added 190,000 jobs, down from the 272,000 reported in May’s blockbuster report.

-

That would mean a 42nd consecutive month of labor market expansion, keeping the unemployment rate at 4 percent.

-

Hourly earnings are expected to have risen by 3.9 percent on an annualized basis, also below the May number.

A big focus will be on wage growth. There are indications that pay gains have steadily eased this year, helping to slow inflation. That may be because workers appear to be more content to stick with their employers, Bank of America economists said in a research note last week.

It’s a sign that the frenetic job-switching defined by the “great resignation” era has been replaced by a more fixed period that economists are calling “the great hesitation.”

Down rounds are on the up

A moribund I.P.O. and M.&A. market, and high interest rates, have put a cap on skyrocketing valuations, even as investors line up for a piece of hot artificial intelligence start-ups like OpenAI, Mistral and Anthropic.

But in this difficult environment, raising money at a flat or lower implied valuation isn’t as damaging to a start-up’s reputation as it once was and investors are rethinking how they assess a company.

Down and flat rounds account for an increasing portion of venture capital deals. This year, they have accounted for about a quarter of all deals compared to about 15 percent in 2019, according to data from PitchBook, which tracks start-ups.

“The reality is that the valuation environment is just very different with 5 percent interest rates compared to where things were in 2021,” Rich Wong, a partner at the venture capital firm Accel, told DealBook. “This is just revaluing the way a successful company might be looked at in the market.”

“Winter is here for start-ups,” said Venky Ganesan, a partner at Menlo Ventures. “What matters now is just finding safety and riding through the storm.”

THE SPEED READ

Deals

-

Shares in SoftBank hit a record as shareholders applaud the Japanese tech investor’s bets on artificial intelligence. (Bloomberg)

-

Bob Iger of Disney and his wife, the journalist Willow Bay, are reportedly set to buy Angels F.C., the Los Angeles soccer team, in a deal that values the club at $250 million — the highest valuation for a pro women’s franchise globally. (Semafor)

Artificial intelligence

Best of the rest

We’d like your feedback! Please email thoughts and suggestions to dealbook@nytimes.com.